NAVIGATING PCAOB INSPECTIONS

Third Edition: 2025 Update

A roadmap through the PCAOB inspection and remediation process

Best practices to reduce your regulatory risks.

Lessons learned from our work with small and large firms worldwide.

Actions to apply and implement continuous audit quality improvement.

Firms performing PCAOB audits are facing increasing headwinds for compliance including new reporting requirements, quality management implementation, and increasing pressure from various stakeholders for quality improvement. This comes at a time when firms are already faced with limited resources. When firms learn an inspection is coming, many of the questions are:

- Already another inspection?

- Aren’t we still in remediation for the last inspection?

- Do we have time and resources to devote to this?

- What will they find this year?

- Will the PCAOB ever really be satisfied?

- How do we get our engagement teams best prepared for this inspection?

- Where do we start?

What firms face in an inspection, and what stakeholders see reported in inspection reports, continues to evolve. Our work with firms and insights gained has shown new techniques regulators are using to identify areas of non-compliance.

There is no disputing that each evolution results in a more comprehensive and robust process, which has improved audit quality. At the same time, this evolution translates to higher levels of stress to meet these performance expectations for firms.

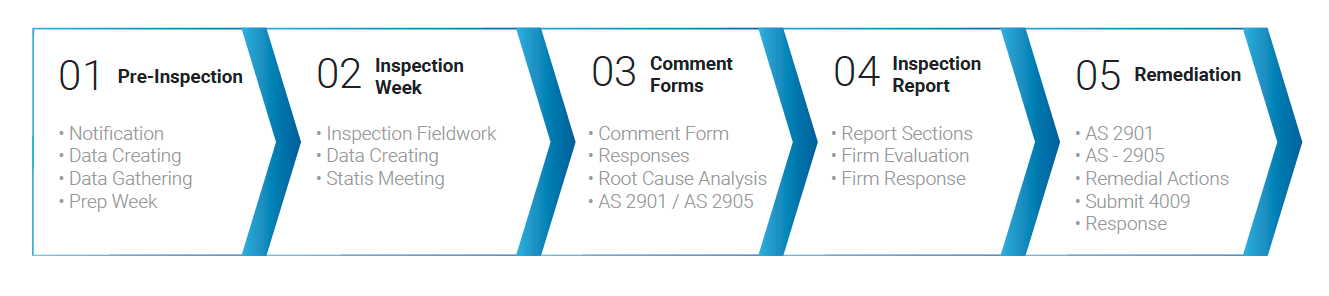

Our newest 2025 3rd Edition of Navigating PCAOB Inspections: Understanding the Inspection Process from Start to Finish, pulls from our extensive experience advising and working with a variety of firms through each step of the process. The goal of this Guide is to provide firm management and engagement teams’ step-by-step guidance throughout the inspection process. This document is intended to not only be a “how-to” guide of the process but to also provide thoughtful considerations to help steer firms in the right direction.

Whether you are new to this process or not, we hope this whitepaper will serve as your guide throughout the inspection process. Please share with your staff so that everyone involved can successfully navigate the PCAOB inspection process. As always, we welcome your comments and questions and we are always here to help discuss and provide advice on your firm’s particular situation.

For questions or to obtain a printed copy, please contact info@jgacpa.com.

* Downloading this white paper will sign you up for our newsletter. At Johnson Global, our goal is to keep you informed, not clutter up your inbox. You can unsubscribe at anytime.