Quality Management in 2026: Considerations to Successfully Adapt to a Transforming Environment

Introduction

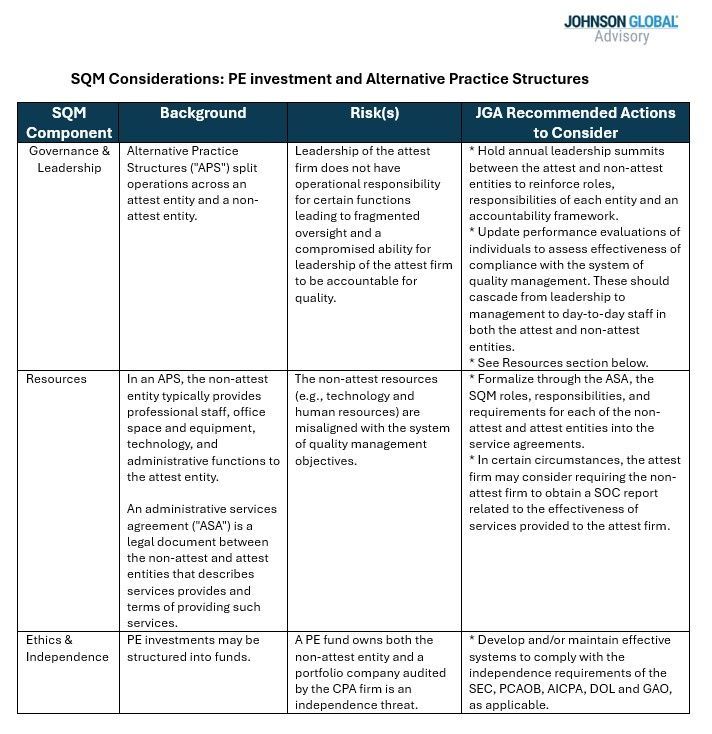

The accounting firm industry experienced a ground-breaking transaction in August of 2021 when TowerBrook acquired EisnerAmper, which marked the first private equity (“PE”) transaction of a large-scale accounting firm. This transaction was structured using an alternative practice structure (“APS”).

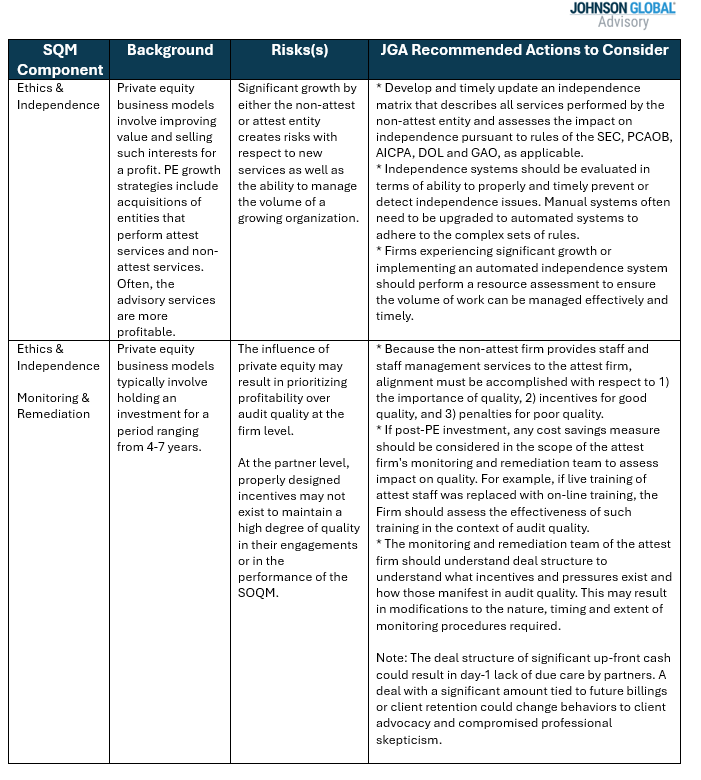

Historically, licensing and independence rules have barred non-CPAs from owning accounting firms. Through an APS, a PE firm may invest in the non-attest entity with service lines such as tax advisory and consulting. The CPA partners retain control over the attest functions, which preserves regulatory compliance. While the APS model has been in existence since the 1990s, this August 2021 transaction brought new attention to this structure. What has followed is an extraordinary volume of deal activity.

Per the CPA Trendlines (“CPAT”) Cornerstone report posted on November 18, 2025, CPAT has tracked over 115 PE-related transactions from 2020 to 2025, with over 80 transactions in 2025. While PE in the accounting firm space is no longer news, the pace and volume of transactions is certainly news-worthy.

Impact of PE Investment

The impact of PE investment on the accounting firm space is unprecedented. The APS has enabled PE to fuel billions of capital investment. PE-backed firms provide immediate payouts to partners at appealing valuations while providing access to capital to these firms for merger and acquisition growth, technology investments, and other priorities. Well-capitalized firms now have an improved ability to invest in technological capabilities, attract experienced talent to be more competitive for college graduates, and improve their market position.

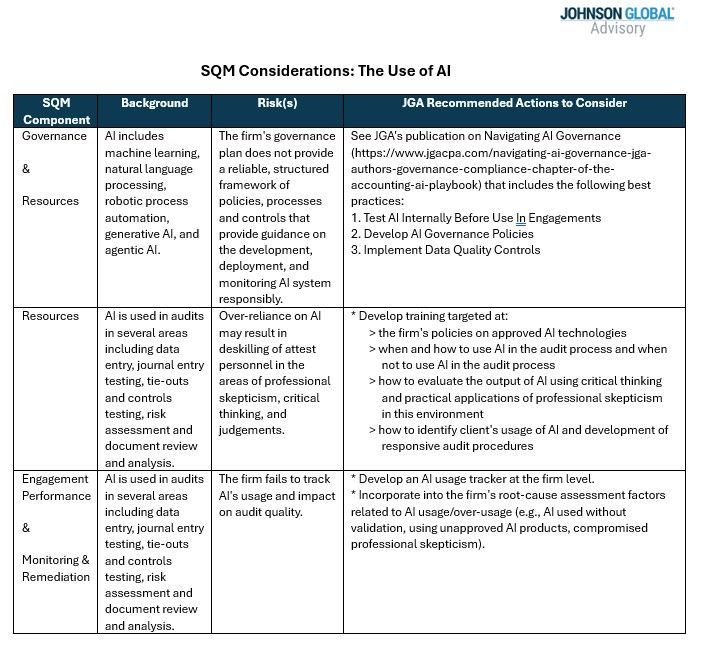

With new technologies, routine tasks are being automated such as data entry, tie-outs and controls testing, resulting in less time needed to perform certain audit procedures.

What the regulators are saying

At the AICPA December 2025 conference on Current SEC and PCAOB Developments, common topics were the presence of private equity in the accounting firm space and the opportunities and challenges that come with this investment.

PCAOB

Acting PCAOB Chair George Botic described that both transformative technologies (e.g., artificial intelligence or “AI”) and the continuing expansion of private equity investments in accounting firms are two developments that bring opportunities and challenges. Mr. Botic noted that while AI has enhanced risk assessment, reduced manual processes and made it possible to efficiently analyze entire populations of data (which can reduce the risk of missing irregularities or unusual patterns), that overreliance on AI may ultimately threaten auditors’ exercise of professional skepticism and judgment. As it relates to private equity, Mr. Botic noted that while these investments have the potential to enhance audit quality by increasing firm capacity and modernizing audit tools with advanced technologies, the presence of private equity presents a risk that firms shift incentives to prioritize profitability over audit quality. Mr. Botic stated, “Both AI and private equity investments in accounting firms carry the potential to truly reshape the profession. Yet these opportunities come with clear challenges to ensure that overreliance on AI and the pressures of private equity do not jeopardize audit quality.”

SEC

SEC Chair Atkins discussed in his remarks that he would like the PCAOB to modify its inspections process to place more reliance on the system of quality management and that inspection of certain engagements would inform the PCAOB if the firm’s system of quality management is effective. He also expressed a view that accountability for audit quality should move upward to firm leadership.

How is a firm’s system of quality management (“SQM”) impacted?

Today’s transforming environment has far-reaching impacts on a firm’s SQM. This publication will focus on risk assessment, governance and leadership, ethics and independence, resources, engagement performance, and monitoring and remediation.

Conclusion

The APS comes with structural complexity that challenges the design and operation of effective systems of quality management. Key risks include independence impairments, fragmented governance, and inconsistent risk monitoring. When an APS is coupled with PE investment, use of transformative technologies, profit prioritization and pressure may be added to the mix of risks at play.

The regulators have weighed in on the importance of these topics. We advise firms to carefully assess these issues to ensure they implement robust governance frameworks, establish clear accountability, and enhance monitoring protocols to mitigate these risks.

Ready to get started or need help refining your approach? Contact your JGA audit quality expert today to schedule a consultation and ensure implementation is tailored to your firm’s needs.

Joe Lynch, JGA Shareholder, to Provide Insights on Changes to Engagement Quality Review Requirements